Given the positive developments in the domestic economy and recent global trends, the Development Budget Coordination Committee (DBCC) has reviewed the government’s medium-term macroeconomic assumptions, fiscal program, and growth targets for fiscal years (FY) 2023 to 2028.

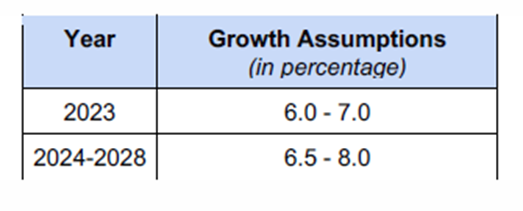

Real Growth Projections

For the first quarter of the year, the Philippine economy expanded by 6.4 percent, making the country one of the best-performing economies in the Asia-Pacific Region. It grew faster than other developing and emerging economies, such as Indonesia, China and Vietnam.

We have maintained our growth assumptions at 6.0 to 7.0 percent for 2023 and 6.5 to 8.0 percent for 2024 to 2028, taking into account both domestic and external risks. These projections have already taken into account the risks posed by El Niño and other natural disasters, global trade tensions, and value chain disruptions, among other factors.

The DBCC is confident that the country can withstand these risks and achieve upper-middle-income status in the next two years through the implementation of near and medium-term strategies, such as ensuring timely and adequate importation, providing preemptive measures to address El Niño, strengthening biosecurity, enhancing agricultural productivity, and pushing for legislative reforms including the Livestock, Poultry, and Dairy Competitiveness and Development Act, among others.

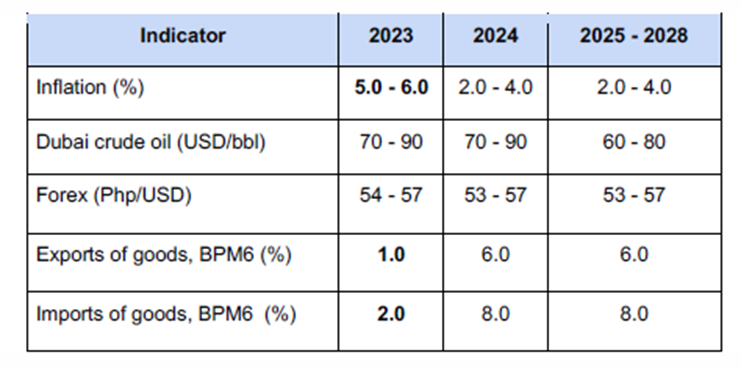

Macroeconomic Assumptions

The DBCC has approved the following revisions to the macroeconomic assumptions:

The average inflation rate assumption for 2023 has been narrowed to 5.0 to 6.0 percent from the previous assumption range of 5.0 to 7.0 percent partly due to a consistent slowdown in inflation over the past four months. It is expected that the inflation rate will return to the target range of 2.0 to 4.0 percent by 2024 and 2028 as the administration, through the Inter-Agency Committee on Inflation and Market Outlook (IAC-IMO) provides proactive measures to address the primary drivers of inflation. This, together with appropriate monetary policy actions of the Bangko Sentral ng Pilipinas (BSP), will help ensure a return to the inflation target over the policy horizon.

Meanwhile, the assumption for the price of Dubai crude oil for 2023 to 2024 is maintained at USD 70 to 90 per barrel before stabilizing to USD 60 to 80 per barrel in 2025 to 2028 as the latest future prices and forecasts still suggest falling global crude oil prices over the medium term.

The peso-dollar exchange rate assumption for 2023 is narrowed down to USD 54 to 57 and is expected to be broadly stable at USD 53 – 57 for the remainder of the medium term. The peso will continue to be supported by structural foreign exchange inflows and ample international reserves.

Goods exports and imports growth projections for this year were revised downwards at 1.0 percent and 2.0 percent from 3.0 percent and 4.0 percent, respectively, following the trend in near-term global demand outlook and trade prospects. These are expected to stabilize at 6.0 percent and 8.0 percent, respectively, in the medium term.

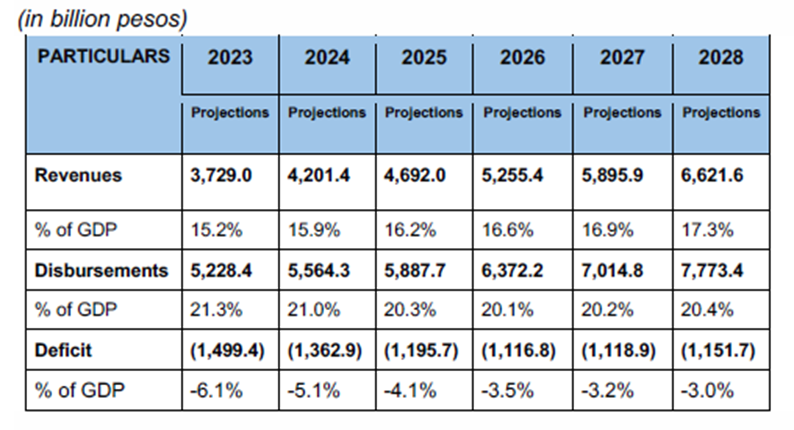

Medium-Term Fiscal Program

The DBCC maintains its commitment to ensuring sound fiscal management guided by the Medium-Term Fiscal Framework. This is reflected in the strong fiscal performance for the first four months of the year with actual revenues inching up to PHP1.26 trillion, higher by 11.2 percent due to improved tax administration. This is projected to reach PHP3.729 trillion by the end of the year and further rise to PHP6.622 trillion in 2028 through the implementation of revenue-generating measures over the medium term.

Meanwhile, disbursements will remain above 20.0 percent of GDP over the entire plan period, with priority given to infrastructure and socio-economic development. Deficit is also targeted to gradually reach pre-pandemic levels of 3.0 percent of GDP in 2028 from this year’s 6.1 percent.

FY 2024 Proposed National Budget

Consistent with the macroeconomic assumptions and foregoing fiscal targets, the national government is currently preparing the FY 2024 proposed national budget, amounting to PHP5.768 trillion, higher by 9.5 percent compared to this year’s budget. The proposed national budget will continue to prioritize expenditure items that promote social and economic transformation through infrastructure development, food security, digital transformation, and human capital development. Acknowledging the competing demands of government programs against a backdrop of limited resources, DBCC shall ensure that the FY 2024 National Expenditure Program will only include implementation-ready agency proposals.

Closing Remarks

The DBCC commits to continuing its proactive efforts to sustain the high-growth trajectory of the Philippine economy towards realizing the AmBisyon Natin 2040 of Filipinos for a “matatag, maginhawa, at panatag na buhay.” With clear coordination with government institutions, DBCC will strive to implement reforms and strategies that will have lasting impacts on the country’s fiscal resources, business climate, and ultimately, the lives of Filipinos.